If taxpayers fail to report their earnings, they may be subject to a 20% capital gains tax, in addition to interest and penalties that may reach 200% of the total amount owed. Anyone caught trying to avoid paying the crypto tax UK might be subject to criminal prosecution and perhaps prison time. You must know what will happen if you don’t submit your Bitcoin taxes. Still, you should report all of your income and capital gains in the correct way to avoid penalties.

What Impact Has Brexit Had On Community Paying Crypto Tax UK?

In recent years, Brexit has been one of the most consequential geographical and political developments for the United Kingdom and the European Union. The area’s economic base was expected to be profoundly affected. However, unlike before, when it was unable to do so owing to EU restrictions, the UK now has the chance to ride the Bitcoin wave and become fond of the notion thanks to Brexit.

Increased regulatory constraints on cryptocurrency’s use internationally have hindered its mainstream adoption despite its popularity. Many of these regulations stem from concerns that cryptocurrencies might be used illegally, such as laundering money or financing terrorists. When it comes to the UK’s politics, society, and economy, Brexit is a weighty and complicated issue. The United Kingdom could focus on the bitcoin sector if this happens.

The UK’s crypto community is expanding at the same rate as the rest of the world, and with Brexit’s easing of regulations comes intriguing new opportunities.

With the consensus among industry insiders that cryptocurrencies are not going anywhere, many are calling on national and state governments to prioritize the creation of crypto models that would allow their residents to reap the benefits. Legislators and regulators in the UK are more optimistic about Bitcoin’s post-Brexit economic prospects.

Also Read: Which Is Best UK Crypto Exchange? What Made It So Long To Legalise Cryptocurrency In UK?

When Do You Need To Pay Crypto Tax UK?

Whenever you get cryptocurrency, you must report it as income and can also pay your crypto tax UK on it. Among them are:

- Paying workers

- Money exchanged for products or services

- Profits from Mining

- The stake rewards depend on whether they are considered cash or income

- Whether they are considered capital or income determines the

- liquidity mining rewards.

- Profits from Loans

- Earnings from Play to Earn and related ventures might also apply

Income from cryptocurrencies in the UK may be taxed in a few different ways: as employment income, as self-employment income, or as miscellaneous income. People should be aware of each group’s particular crypto tax UK consequences.

What are Airdrops, Forks, and Staking, Belongs To Crypto Tax UK?

Anyone who has taken part in a cryptocurrency airdrop is considered to have bought the asset for free, and their holdings will either be added to the pool or used as collateral for a sale. The amount of the airdrop can be taxable if the recipient is considered trading and must pay income tax.

Assuming a fork leads to the creation of a new crypto asset, the person must assign a portion of the old cryptocurrency’s value to the new asset. This does not directly result in a tax bill, but it does divide the old asset’s cost, making it more likely that a larger bill will be due upon disposal in the future. The value of any crypto assets obtained by a trader will be subject to crypto tax UK. Income from staking, which is similar to investment income, is considered taxable regardless of whether or not a person is really trading.

What Is Fundamental Analysis In The Crypto Tax UK Based Market?

Investors use fundamental analysis (FA) to determine a company’s or resources true worth. Based on a variety of internal and external criteria, their main goal is to determine whether the resource or company is undervalued or overpriced. Investors may then use the information to join or exit holdings strategically. A key component of crypto fundamental analysis is delving deeply into publicly available information on a resource’s value.

You can find out who’s behind the project, how many people are using it, and what use cases it has. Finding out whether the resource is cheap or expensive is likely your achievement. Then, you’ll be in a position to advise your trading positions based on your expertise. The majority of Bitcoin initiatives need to be structured like conventional businesses. Different from traditional stock shares, there isn’t a mountain of data pertaining to every cryptocurrency’s price history that you need to go through.

Consumer Trends in Cryptocurrency – Crypto Tax UK

The biggest obstacle to consumers interacting with Bitcoin, despite its popularity, is the need for more consumer education about it. When asked why they had never invested in cryptocurrencies, over two-thirds of customers said they didn’t understand it. With such a youthful primary audience, cryptocurrency exchanges must take the initiative to increase customer comprehension.

Consumer confidence can only be increased by regulation of the cryptocurrency business, which presents a tremendous chance to attract investors beyond the realm of speculation. More than half of the population believes that if Bitcoin were regulated, investors would feel safer. Clear regulation will help Bitcoin reach its full potential by reducing the market’s present degree of ambiguity, which is good news for both users and exchanges.

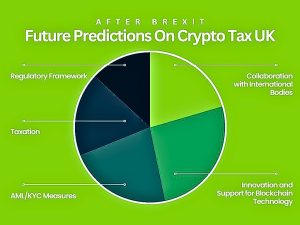

Future Predictions On Crypto Tax UK after Brexit?

Predicting the future of cryptocurrency tax and regulations in the UK post-Brexit involves several factors and uncertainties. However, here are some potential developments based on current trends and possible scenarios on crypto tax UK:

1. Regulatory Framework: The UK may continue to refine its regulatory framework for cryptocurrencies to provide clarity and protection for investors while fostering innovation in the fintech sector. There could be efforts to strike a balance between promoting innovation and safeguarding against financial risks and illegal activities such as money laundering and fraud.

2. Taxation: The UK government might introduce clearer guidelines on the taxation of cryptocurrencies, including capital gains tax (CGT) on profits from trading or selling cryptocurrencies and income tax on mining or staking rewards. There could be changes in tax rates or thresholds, and HM Revenue & Customs (HMRC) may enhance its enforcement efforts to ensure compliance with tax obligations related to cryptocurrencies.

3. AML/KYC Measures: The UK might strengthen anti-money laundering (AML) and know your customer (KYC) regulations for cryptocurrency exchanges and service providers to prevent illicit activities and enhance consumer protection. This could involve stricter identity verification procedures and reporting requirements for suspicious transactions.

4. Collaboration with International Bodies: The UK may collaborate with international organizations and regulatory bodies to establish common standards and practices for regulating cryptocurrencies and addressing cross-border challenges. This could include participating in discussions at forums such as the Financial Action Task Force (FATF) to develop global regulatory frameworks for virtual assets.

5. Innovation and Support for Blockchain Technology: Despite regulatory oversight, the UK government may continue to support the development and adoption of blockchain technology through initiatives such as research funding, regulatory sandboxes, and partnerships with industry stakeholders. This support could help drive innovation in various sectors, including finance, supply chain management, and healthcare.

Brexit Impact On Crypto Market in UK: The UK’s departure from the European Union could influence its approach to cryptocurrency regulation and taxation. The UK might choose to diverge from EU regulations to create a more flexible regulatory environment that fosters growth and competitiveness in the cryptocurrency industry. However, alignment with international standards and maintaining access to global markets could also be priorities for the UK post-Brexit.

Overall, the future of cryptocurrency tax and regulations in the UK after Brexit is subject to various economic, political, and technological factors. Continued monitoring of government policies, industry developments, and global trends will be essential for stakeholders to navigate the evolving regulatory landscape effectively. For more understanding, learn with our UK crypto guide.

Also you can read Unbiased great article on UK crypto tax guide in detail.

Conclusion

Like other cryptocurrencies, Bitcoin hit a record high in 2021 before entering a protracted decline. By the beginning of 2022, the price of Bitcoin had fallen 42% from its peak. Price fluctuations like the ones Bitcoin is now seeing are nothing new, and there’s no assurance that the next year won’t bring more of the same for BTC and other cryptocurrencies. Crypto tax UK is exceptionally complicated, but investors should keep in mind that investing in every asset class has the risk of loss, including invested funds.